THINK YOU KNOW THE MI AUDIENCE?

You don’t know the half of it…

State of the Industry

It’s been tough to stay optimistic about the state of the music industry lately. Complaints and concerns that were once only whispered (sotto voce) or talked about off-the-record have become a common refrain, debating causes and potential solutions to the current MI funk.

But take heart. It may not be all sunshine and rainbows out there, but we’ve got to work through the gloom first. Stick with us.

Data shows that the overall musical instrument market is down more than 10% over 2005 sales figures. (Of course, that number cannot show what the industry’s growth “should’ve” or could have been, absent the mighty microprocessor and its natural push toward greater power and lower costs, not to mention outsourced manufacturing, increasing media proliferation, and the devaluation of purchased music in general.)

To compound the upheaval, some of the industry’s biggest names have transferred ownership. Retail channels continue to shrink. Manufacturers are being forced to compete against their own quality products on Ebay or Craigslist at bargain prices. On top of all that, the traditional marketing methods and media tactics for reaching the public are in such flux that it’s become a college student’s full-time job just to keep up. Large and small MI manufacturers are asking themselves – What the heck is happening and how do we turn this around?

So Who is the MI Audience?

As musicians who also happen to be marketers, our job is to get inside the collective heads of our consumer-audience, to find out who they are, what’s currently popular, and where the trends may be heading. So our team set out to learn the true scope of the impact of the often mentioned “millennial market” and see how it measured up against traditional “old guy” MI guitar buyers.

The expectation was that millennial shopping behavior would follow the same general patterns in the music business as shown by the consumer group elsewhere. We looked for similar roadblocks to reaching this new generation of buyers that have cropped up in other industries: e.g., myriad distractions (electronic and otherwise) competing for free time; little love or knowledge of history (since they haven’t lived much of it), little earning power or spending money for luxuries, and so on.

After setting aside preconceived notions about the state of the MI audience and looking at the actual results of the study (checked and rechecked to overcome any skepticism about the accuracy), minds were well, truly blown.

Survey Says…

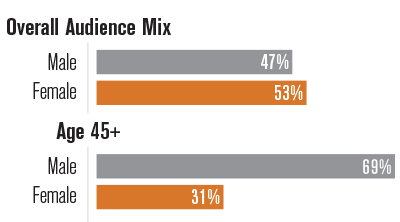

“More than half of the audience is… FEMALE!?” The report was commissioned by us, the brainyard, a media and marketing agency in Southern California (with clients such as Fender, Taylor Guitars, and Elixir Strings, among others). Initially there was concern that the narrow search terms (including over 100 related terms) would not produce a statistically reliable data set for the past 12 months, due to the hyper-specific query line (“plays guitar” and “makes guitar searches”). However, after using the HitWise, Experian, and Simmons data platforms (audited by PriceWaterhouseCoopers), the cross-sectional search results confounded expectations (again) by producing a sample four times larger than that required to qualify as valid.

Checking Your Bias

We went to NAMM 2016 and conducted our own informal industry survey with over 40 industry insiders about the composition of the guitar-shopping audience. The question asked was simple, “what percentage of the active MI market consists of girls below the age of 40?” Their confident answer was “15%….tops.”

Then we asked what percentage of guitar-searching and playing females were over the age of 41. Many figured that number to be much less than 10%: we repeatedly heard, “5%….max.”

Aside from a handful of companies that already happen to make guitar products intrinsically friendly to this audience category (e.g. Taylor Guitars), it would seem that anyone claiming to know the actual number would be bluffing, to put it politely.

Now that we know

More effective communication begins with knowing your audience well. After opening our minds to the true makeup of the market, we’re continuing to unlock some of the secrets of reaching this new majority, as well as making greater penetration with real players and buyers.

The surprising conclusion revealed by the research is causing us to think differently about how and where to find answers to address the communication imbalance and reach this underserved audience more effectively. We hope it will help you to think outside of your own music box.